Finance is a discipline that studies primarily the production, distribution, consumption, and savings of money. This term is directly related to the management of money and currencies. Financial management and financial planning are the needs of the hour for all the top companies and government organizations. Without the management of wealth, no business can function properly; this is why it is termed the “foundation of business organization.” There are plenty of financial degrees available at top universities that help students learn everything from top to bottom about how they can effectively contribute to the success of businesses.

There is no doubt that with a finance degree, you can have a good understanding of financial analysis and get high-paying jobs. However, if you want to increase your employability, then you need to participate in financial certificate course programs. There are multiple short-term and long-term training programs available to help you develop your financial knowledge and skills. In this blog post by tutemyclass.com, we will explore the six best finance certificate programs that will help you get a good understanding of financial concepts and management.

Also Read: What Are the Several Types of Accounting?

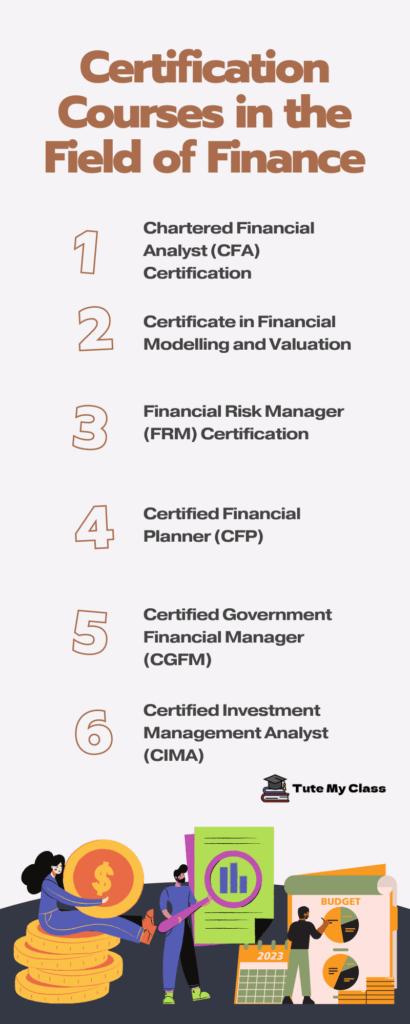

Certification Courses in the Field of Finance

Are you a finance professional working for a multinational company? Do you want to move forward in your career and be successful in life? You must recognize that working nine hours a day for years will not help you advance because you will be doing the same task on a regular basis. If you want to move ahead, developing your knowledge and skills related to your field is important. As a financial professional, finance certification course programs are the best way to advance in your career. Below are the best certification courses in finance that will help you get a better understanding of finance.

If you have not yet enrolled in finance certification courses, then it’s time for you to know their benefits. Enhancement in personal knowledge, development in your career, and an in-depth understanding of new trends that will help you to move forward without any difficulties. These are just a few of the advantages. So you must not miss the opportunity to enroll in and get finance certification courses.

1- Chartered Financial Analyst (CFA) Certification

If you are thinking about your next step after your finance degree, this certificate program is the right one. The scope of these programs is broad, and they are accepted in different finance-related fields. To become a certified financial analyst (CFA), one must complete an examination and have related work experience.

- There are multiple benefits to getting chartered financial analyst certification. One of which is that you can use a portfolio management service. Other benefits include a strong foundation in investment analysis, reaching greater heights in your career, and a good impression on your employers.

- After completing this three-part exam, one can work in senior and executive positions.

2- Certificate in Financial Modelling and Valuation

Financial Modelling and Valuation certificate courses help students learn more about financial models. This certificate course is a perfect blend of industry practices where one can learn about data visualization, Corporate finance, investment banking, and many other finance courses.

- Finance professionals, MBA graduates, Chartered accountants, and equity researchers are a few of the individuals who are eligible to study these finance certification courses and advance in their careers.

- Different topics related to investment banking are covered in this certificate course. Introduction to Investment Banking, Foreign Exchange and Money Markets, Cash Equities, and Fixed Income are a few of the main topics in this course.

3- Financial Risk Manager (FRM) Certification

Financial Risk Manager (FRM) is a certificate course that briefly studies risk management. This finance certification course is divided into two divisions: FRM Part 1 and FRM Part 2. One must clear these two parts to be eligible for FRM course certification. Students studying this course gain transferable knowledge and the ability to work in real-world situations.

- A financial risk manager is one of the most important jobs in the world, and many top companies are actively hiring them for good positions. ICBC, HSBC, UBS, KPMG, and PWS are the top companies hiring.

- Do you know that many of the top global banks are also welcoming financial risk managers? A few of them include China Construction Bank, Agricultural Bank of China, Bank of America, Bank of China, and JP Morgan Chase.

Also Read: Why Do Students Find Mathematics So Difficult to Learn?

4- Certified Financial Planner (CFP)

Certified Financial Planner is another popular financial certification course. It is offered by the Financial Planning Standards Board (FPSB). A certified financial planner gets rigorous training and achieves excellence in financial planning. CFP is also a high earning certification in finance. There are two ways to participate in this course program and learn new skills.

- The first one is known as the regular one. Anyone who has taken accounting and commerce as their major in 12th grade can enroll in this certificate program and start studying.

- The second one is known as the challenging one. This is different from the regular one. Anyone who is from an accounting background or has been pursuing any other finance courses can be a part of this financial certification course.

- With a CFP certificate course, one can work in different fields of financial advisory services.

5- Certified Government Financial Manager (CGFM)

This is a professionally certified financial course and is best suited for someone who is planning to become a financial analyst. With this certified course, one can become a professional government financial manager and effectively serve at the federal, state, and local levels. One should meet four requirements to become a Certified Government Financial Manager. They are ethics, education, examination, and experience.

- All the aspirants to CGFM need to follow the rules and code of ethics laid out by the Association of Government Accountants (AGA).

- One can become a CGFM by completing its examination, but to use the name and keep it active, one must complete 80 hours of professional education.

6- Certified Investment Management Analyst (CIMA)

It is one of the internationally recognized certificate programs. This certificate program is awarded by the Investments and Wealth Institute and is best suited for financial analysts. If you’ve been searching to take one of the most popular financial certification courses, this is the one for you.

- Completing this field of study might not be easy, as it is observed to be the most difficult finance certification course. However, after completion, you can expect to earn better compensation.

- CIMA is an international certification, and the certificate’s validity is about two years.

- Different Pearson VUE test centers regularly conduct the CIMA examination, and the best part is that students can take this exam from their respective countries.

As a finance professional, managing your work and certificate courses can be tough. If you find managing your studies difficult, rely on professional help. They will provide you with timely assistance and handle all of your classwork. Do you know that online helpers have expertise in all the major subjects taught in schools and colleges? You can get help with any of your online classes without any difficulty. Do not seek help alone; let your friend know and guide them too. If your friend is pursuing an English degree, he or she can get help by asking, Can someone take my online English class for me?” Anyone from any field of study pursuing it from anywhere can get assistance and pass their online classes with A grades.

A List of the Top Online Finance Courses

Studying finance will help you advance in your career opportunities. You can learn any of the below-given finance courses at your own pace and develop your knowledge.

- Mathematical Methods for Quantitative Finance

- Essential Career Skills for Investment Banking and Finance

- Finance for Everyone: Smart Tools for Decision-Making

- Machine learning with Python for finance professionals

- Introduction to Corporate Finance

- Macroeconomics of Climate Change: Green Public Finance

- Fundamentals of International Trade Finance

- Introduction to Behavioural Finance

- Introduction to Mathematics for Finance and Business

- Machine Learning Use Cases in Finance

Are you someone who finds finance a difficult subject to study and work on? No worries; you are not alone in this. Finance and accounting are subjects that most students struggle to score good grades in. So, what can you do about this? You can get help from reputed professionals who have knowledge about all subjects. Whether you are studying finance or accounting, you can get help by asking, Can someone take my online accounting class for me? Or Can you do my finance class for me? With this request, you may get the best possible help online and remove your academic burden.

Frequently Asked Questions

| Question 1: Is a short-term certification finance course a great way to learn? Answer 1: Yes, it is the best way to learn about financial analysis, risk management, and financial planning. With short-term finance courses, you can not only learn and develop knowledge but also actively work in the finance field. |

| Question 2: How long will it take to finish a short-term finance course? Answer 2: Completing short-term financial certificate courses can take around six months or more. |

| Question 3: What are the various short-term financial certification courses? Answer 3: Financial Modelling, Certified Financial Planner, International Financial Reporting Standards (IFRS), and Chartered Wealth Management (CWM) are a few of the top courses to pursue. |