Are you someone who is looking to start a career in accounting or a related field? If you answered yes, it is the right time to begin your career and start learning different types of accounting. Accounting is one of the fastest-growing fields. If we look at the growth of accounting services worldwide, it has seen $652.32 billion growth in 2023. In 2024, it is estimated to be $676.73 billion, at a compound annual growth rate (CAGR) of 3.7%. Accountants and auditors’ demand is also rapidly growing in the United States of America. It is assumed that accountant jobs will expand by 4 percent from 2022 to 2032, which is slightly higher than any other profession.

Before starting a career in any field, it is important to know everything about it to choose the best path. The same goes for the accounting industry. Don’t worry, you don’t have to go anywhere to look for this information. In this blog post, we have briefly discussed the different types of accounting and determined which type of accountant you might need. Go through everything, find your area of interest, and start your learning. Moreover, if you ever struggle with an online accounting class, you can seek online class help. With the right professional help, you can improve your grades and understanding of subjects.

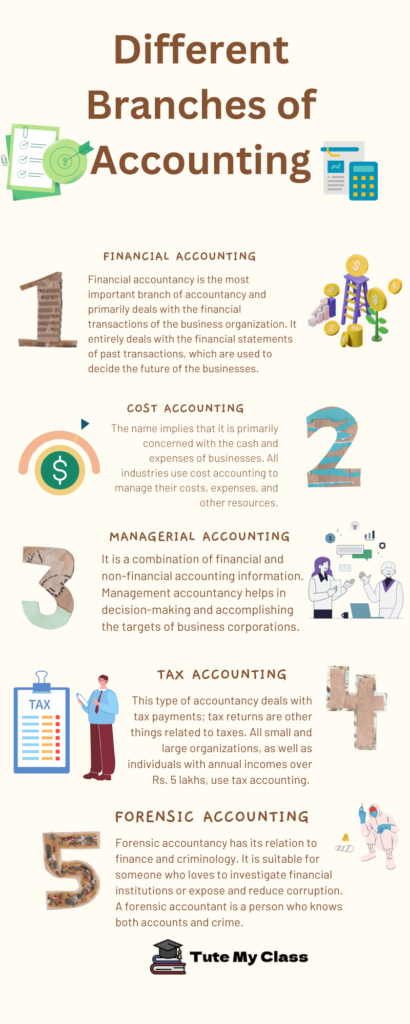

Different Types of Accounting

To all the students who are looking forward to making a career in accounting, it is advised to learn different types of it first. A correct knowledge of the following specializations will assure you that you are following the right path. Do you know first what the accounting specializations are? In simple terms, it is a set of applicable rules and techniques. Each of the accompanying branches is different and follows different industry-specific practices. The main reason accounting subdivisions exist is to provide better approaches for business organizations.

As I said earlier, accounting is one of the fastest-growing and most in-demand professions in the world. You can enroll in any of the accounting courses to move forward in your career. Before everything else, good grades in your accounting degree are a must for you. You can rely on professional help to get the best marks in your accounting courses. Do you know how to get help? Just ask, Can you do my accounting online class for me? With this request, you may get immediate help from the accounting experts.

Let us now explore the major branches of accounting.

1: Financial Accounting

Financial accounting is the most important branch of accounting and primarily deals with the financial transactions of a business organization. It entirely deals with the financial statements of past transactions, which are used to decide the future of businesses. This account standard is dealt with by both the local and government offices.

Financial accounting follows Generally Accepted Accounting Principles (GAAP), or International Financial Reporting Standards (IFRS), and the International Accounting Standards Board (IASB) as its basic guidelines. The cash flow statement, income statement, profit and loss statement, statement of operations, and balance sheet are parts of the financial statement.

2: Cost accounting

The name implies that it is primarily concerned with the cash and expenses of businesses. All industries use cost accounting, as it helps determine the cost of production, expenses, and other resources. This type of accounting helps companies evaluate all of their money and allocate costs associated with producing goods or services. It helps them learn how to spend the money, where to spend it, how it is spent, what its expenses are, and how to calculate the gains and losses.

To learn more about this, you can do so with the help of the cost accounting cycle. Direct costs, indirect costs, variable costs, fixed costs, and operating costs are the five different types of costs.

Also read: Top Career Opportunities After a Nursing Degree

3: Managerial Accounting

It is a combination of financial and non-financial accounting information. Management accounting helps in decision-making and accomplishing the targets of business corporations. Management accounting is also called management or cost accounting. Unlike financial accounting, it is not bound by GAAP or IFRS. Let us look at the major purpose of this type of accounting in business.

- Planning

- Summarising

- Recording financial pieces of information

- Making and revising the decision-making policies

- Examining the business goals

- Supervising the financial expenses

- Assisting with financial reporting

- Budgeting

- Forecasting

- Financial analysis

Management accounting does not function in isolation like financial accounting. It provides partial information about accounting standards and reporting financial accounting.

4: Tax accounting

This type of accounting deals with tax payments; tax returns are other things related to taxes. All small and large organizations, as well as individuals with annual incomes over Rs. 5 lakhs, use tax accounting. The terms of a tax account differ for individuals, businesses, corporations, and tax-exempt organisations and help in the filing of tax returns and ensuring compliance with tax laws.

The person who manages the taxes of a business is called a tax accountant, and he or she is considered an external member of the company. Their main work deals with the tax requirements (income tax, professional tax, direct tax, indirect tax, sales tax); they don’t have any rights towards the working company.

5: Forensic Accounting

Forensic accounting has an equally important relationship with finance and criminology. It is suitable for someone who loves to investigate financial institutions or expose and reduce corruption. Forensic accounting is also used in investigations of money laundering and other financial crimes.

A forensic accountant is a person who knows both accounts and crime. He or she mostly works as an investigator of financial records. They work with law enforcement agencies and control financial misconduct. To become a certified forensic accountant, one must complete the Certified Forensic Accounting Professional (CFAP) program.

Also read: Explore the Six Best Finance Certificate Programmes.

6- Auditing

Auditing refers to evaluating the financial statements of a business. Auditing works as a goodwill gesture for the company and helps the investors decide whether their money is safe enough to invest in it or not. The financial audits are conducted by independent auditors or internal audit teams.

The auditor is an external third party who helps verify a company’s financial records. There are three types of audits: external audits, internal audits, and government audits, which provide assurance to stakeholders.

7- Governmental Accounting

Government accounting is one of the popular types of accounting that mainly deals with budgeting, managing, and tracking the government’s finances. Like the International Accounting Standards Board, there is the Governmental Accounting Standards Board (GASB), which clearly instructs what the governmental accountant has to do. There are two different types of accounting principles for both state and local governments.

If you are curious about the basic principles of governmental accounting, then have a look at the information below.

- Financial reporting systems are a must for all public entities as per the principles of governmental accounting.

- The system of accounting is different for both the state and local governments. Here, they both are required to follow the single-entry or double-entry.

- Every asset, liability, and financial statement has to be reported, and public entities and financial reporting must be published annually.

8- International Accounting

International accounting is one of the other types of accounting. Its main purpose is to navigate regional, national, and local laws and regulations. As a financial accountant, one is required to record and track the financial information of an international company. Let us have a look at some information about the International Accounting Standards (IAS).

- International Accounting Standards (IAS) is the first international accounting standard.

- In 2001, the IAS was replaced with the International Financial Reporting Standards (IFRS) by the International Accounting Standards Board (IASB).

- The Financial Accounting Standards Board (FASB) is responsible for releasing guidelines for accounting that should be followed by others.

- The main reason behind the release of International Accounting Standards is to increase transparency and trust in financial reporting.

Accounting is a challenging field of study where most students struggle to score good academic grades. The best way to understand all the academic concepts better is to spend a lot of time learning and practicing. While concentrating on this subject, it is possible to miss out on other classes, like English. But don’t worry; we have a solution for that as well. Rather than wondering who will take my online English class for me, start searching for reliable help and hire professional writers. Once you have a guarantee that qualified writers are working on your English class, you can fully concentrate on learning the types of accounting and making the most of your subject.

How to Learn the Different Types of Accounting

As we all know, accounting is one of the hardest subjects because it is a combination of theories and accounting problems. If you are an accounting student who is struggling to learn the types of accounting, here are a few tips for you to become aware of them and apply them in your study time.

- The first step is to learn about the golden rules of accounting, followed by other financial statements.

- Develop your knowledge about emerging trends in specialized accounting fields. It will help you to answer your theoretical questions.

- To begin your education in financial accounting, understand the workings and differences between the balance sheet, income statement, and cash flow statement.

- Pay special attention to how you are learning accounting. For example, if you are studying in a traditional classroom setting, you may get the right guidance and support from your teachers and do well. If you are on an online learning platform, you should take the initiative to study.

- Do not be lazy, and practice as much as you can. By practicing your accounting practical problems, you can learn to apply your knowledge, which can help you learn faster.

- You have to spare a lot of time, or just half an hour every day, to learn accounting. In addition to these, monitor your progress and achieve your goals.

Frequently Asked Questions

| Question 1: What is the difference between financial accounting and managerial accounting? Answer: Financial accounting deals with managing the financial statements of businesses. Management accounting is one of the types of accounting that aims to provide financial information to help people make the right decisions. |

| Question 2: What are the basics of accounting? Answer: Expenses, revenues, assets, liabilities, balance sheets, income statements, cash flow statements, debts, credits, and trial balances are some of the basics of accounting. |

| Question 3: What are the five types of accounting? Answer: Management accounting, cost accounting, financial accounting, tax accounting, and forensic accounting are the five major types of accounting. |