What is accounting? It is one of the fastest-growing fields. If we look at the growth of accounting services worldwide, it has seen $652.32 billion growth in 2023. In 2024, it is estimated to be $676.73 billion, at a compound annual growth rate (CAGR) of 3.7%. Accountants and auditors’ demand is also rapidly growing in the United States of America. It is assumed that accountant jobs will expand by 4 percent from 2022 to 2032, which is slightly higher than any other profession.

Before starting a career in any field, it is important to know everything about it to choose the best path. The same goes for the accounting industry. Don’t worry; you don’t have to go anywhere to look for this information. In this blog post, we have briefly discussed the different types of accounting and other essentials that will help you enter this field of profession. Go through everything, find your area of interest, and start your learning. Moreover, if you ever struggle with your online accounting degree, you can seek online class help. You can easily seek help by reaching out to websites with queries like, Can I pay someone to take my online class? With the right professional help, you can improve your grades and understanding of subjects.

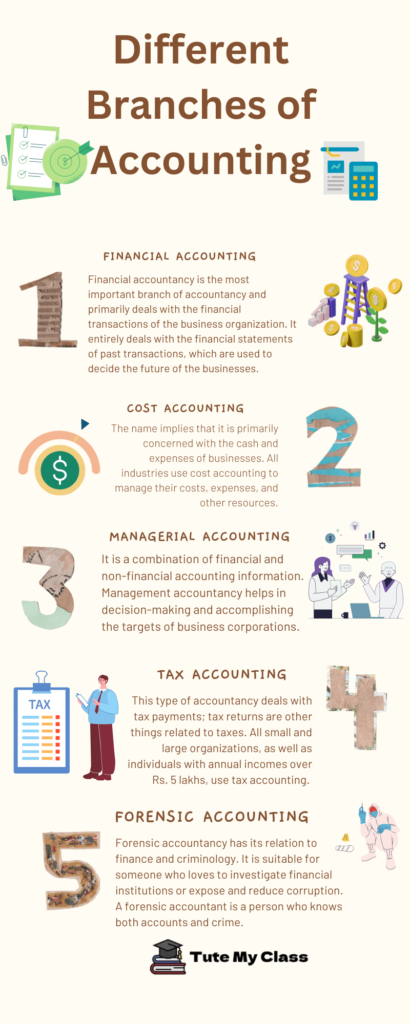

Types of Accounting

A correct knowledge of the following specializations will assure you that you are following the right path. Do you know first what accounting specializations are? In simple words, it is a set of applicable rules and techniques. Each of the accompanying branches is different and follows different industry-specific practices. These subdivisions provide better approaches for business organizations.

Accountancy is one of the fastest-growing and most in-demand professions in the world. You can enroll in any of the accounting courses to move forward in your career. Before everything else, good grades in your accounting degree are a must for you. You can rely on professional help to get the best marks in your accounting courses. Do you know how to get help? Just place a request: Can someone do my accounting online class for me? With this request, you may get immediate help from the accounting experts.

Let us now explore the major branches of accounting.

1: Financial Accounting

What is financial accounting? It is the most branched and primarily deals with the financial transactions of a business organization. It entirely deals with the financial statements of past transactions, which are used to decide the future of businesses. This account standard is dealt with by both the local and government offices.

Furthermore, this specialization follows Generally Accepted Accounting Principles (GAAP), or International Financial Reporting Standards (IFRS), and the International Accounting Standards Board (IASB) as its basic guidelines. The cash flow statement, income statement, profit and loss statement, statement of operations, and balance sheet are parts of the financial statement.

2: Cost accounting

What is cost accounting? The name implies that it is primarily concerned with the cash and expenses of businesses. All industries use cost accounts, as it helps determine the cost of production, expenses, and other resources. This specialization helps companies evaluate all of their money and allocate costs associated with producing goods or services. It helps them learn how to spend the money, where to spend it, how it is spent, what its expenses are, and how to calculate the gains and losses.

To learn more about this, you can do so with the help of the cost accounting cycle. Direct costs, indirect costs, variable costs, fixed costs, and operating costs are the five different types of costs.

Also read: Top Career Opportunities After a Nursing Degree

3: Managerial Accounting

What is managerial accounting? It is a combination of financial and non-financial accounting information. Management accountancy helps in decision-making and accomplishing the targets of business corporations. It is also called management or cost accounting. Unlike financial accounting, it is not bound by GAAP or IFRS. Let us look at the major purpose of this type of accounting in business.

- Planning

- Summarizing

- Recording financial pieces of information

- Making and revising the decision-making policies

- Examining the business goals

- Supervising the financial expenses

- Assisting with financial reporting

- Budgeting

- Forecasting

- Financial analysis

Management accounting does not function in isolation like financial accounting. It provides partial information about accounting standards and reporting financial accounting.

4: Tax accounting

What is tax accounting? This specialization deals with tax payments; tax returns are other things related to taxes. All small and large organizations, as well as individuals with annual incomes over Rs. 5 lakhs, use tax accounting. The terms of a tax account differ for individuals, businesses, corporations, and tax-exempt organizations and help in the filing of tax returns and ensuring compliance with tax laws.

The person who manages the taxes of a business is called a tax accountant, and he or she is considered an external member of the company. Their main work deals with the tax requirements (income tax, professional tax, direct tax, indirect tax, sales tax); they don’t have any rights towards the working company.

5: Forensic Accounting

What is forensic accounting? It is a field that has an equally important relationship with finance and criminology. It is suitable for someone who loves to investigate financial institutions or expose and reduce corruption. Forensic accounting is also used in investigations of money laundering and other financial crimes.

A forensic accountant is a person who knows both accounts and crime. He or she mostly works as an investigator of financial records. They work with law enforcement agencies and control financial misconduct. To become a certified forensic accountant, one must complete the Certified Forensic Accounting Professional (CFAP) program.

Also read: Explore the Six Best Finance Certificate Programs

6. Auditing

What is auditing? It refers to evaluating the financial statements of a business. Auditing works as a goodwill gesture for the company and helps the investors decide whether their money is safe enough to invest in it or not. The financial audits are conducted by independent auditors or internal audit teams.

The auditor is an external third party who helps verify a company’s financial records. There are three types of audits: external audits, internal audits, and government audits, which provide assurance to stakeholders.

7- Governmental Accounting

What is government accounting? It is one of the popular types of accounting that mainly deals with budgeting, managing, and tracking the government’s finances. Like the International Accounting Standards Board, there is the Governmental Accounting Standards Board (GASB), which clearly instructs what the governmental accountant has to do. There are two different types of accounting principles for both state and local governments.

If you are curious about the basic principles of governmental accounting, then have a look at the information below.

- Financial reporting systems are a must for all public entities as per the principles of governmental accounting.

- The system of accounting is different for both the state and local governments. Here, they both are required to follow the single-entry or double-entry.

- Every asset, liability, and financial statement has to be reported, and public entities and financial reporting must be published annually.

8- International Accounting

What is international accounting? Its main purpose is to navigate regional, national, and local laws and regulations. As a financial accountant, one is required to record and track the financial information of an international company. Let us have a look at some information about the International Accounting Standards (IAS).

- International Accounting Standards (IAS) is the first international accounting standard.

- In 2001, the IAS was replaced with the International Financial Reporting Standards (IFRS) by the International Accounting Standards Board (IASB).

- The Financial Accounting Standards Board (FASB) is responsible for releasing guidelines for accounting that should be followed by others.

- The main reason behind the release of International Accounting Standards is to increase transparency and trust in financial reporting.

Accounting is a challenging field of study where most students struggle to score good academic grades. The best way to understand all the academic concepts better is to spend a lot of time learning and practicing. While concentrating on this subject, it is possible to miss out on other classes, like English. But don’t worry; we have a solution for that as well. Rather than wondering who will take my online English class for me, start searching for reliable help and hire professional writers. Once you have a guarantee that qualified writers are working on your English class, you can fully concentrate on learning the types of accounting and making the most of your subject.

Why Study Accounting

Accounting is a universal language, and learning accountancy can provide you with better opportunities. Why study accounting? Below we have discussed a few of the reasons to pursue this field of study.

Better Career Opportunities

Accounting professionals can have high accounting jobs. You can easily find remote accounting jobs in Big 4 accounting firms. Some of the jobs that you can gain by pursuing a degree in accountancy are as follows:

- Budget analyst

- Accounts payable clerk

- Accounts receivable clerk

- Accountant manager

- Bookkeeper

- Forensic accountant

- Financial analyst

- Internal auditor

- Budget analyst

- IT auditor

- Management accountant

- Public accountant

Job Security

Accountants are an integral part of the organizations. Accountancy is known as the business language; the financial transactions are dependent on accounts professionals. With the knowledge of accounting software and skills, you can easily secure your position in the big 4 accounting firms (PwC, Deloitte, Ernst & Young, KPMG)

Learn Transferable Skills

With an accounting degree, you can learn transferable skills that will help you move forward in your career. It is not a degree where you will just learn about numbers, balance sheets, and profit and loss. You can develop many professional skills important for the development of a professional career. Analytical thinking, ethical judgment, communication skills, and time management are some of the transferable skills that can be developed by being a part of this field.

Helps in Personal Growth

Accountancy is a field of study that will help in the development of a professional career. Moreover, it also fosters personal development. The different accountancy skills will help develop a sense of responsibility. Furthermore, it will also help you to contribute to society by promoting transparency, accountability, and trust.

Tips to Pursue Accounting Degree Programs

Learning accounting opens better career opportunities and better job security. However, it is also true that it is a challenging field of study. Students pursuing online accounting degrees often face a lot of difficulties, which makes them wonder, Can someone take my online class for me? If you are also enrolled in any of the online accounting degree programs, here are the tips to achieve success in your course.

- Understanding the core principles and standards of accountancy is one of the problems faced by students. You can overcome this difficulty by focusing on foundational concepts first. The second thing is that you should gradually build your understanding of advanced concepts.

- To effectively understand accounting concepts, you need to first build up your numerical knowledge. Regular practice of calculations, reconciliations, and financial analysis will help you slowly learn accountancy. Moreover, you can also use free accounting software to streamline calculations and reduce errors.

- Follow the most suitable approach for yourself to effectively understand course concepts.

- From time to time, prepare trial balances, financial statements, and journal entries. Doing this will help you understand complex accounting concepts and promote effective learning.

- Double-entry accounting is one of the fundamental concepts that students struggle to learn. Visualization techniques will help you solidify your understanding of the double-entry system.

- Accounting and mathematics are two different terms. Though you are an expert at advanced, it is not necessary that you learn accountancy. To understand the different accounting terms like debits and credits, you need to first practice problems.

- Understanding theory but failing to work on practical solutions is a common problem faced. Once you learn theories, immediately put the learning into practice. Take your time to practice accounting problems. and reinforcement learning.

Frequently Asked Questions

| What is the accounting equation? It is the foundation of double-entry accounting. Assets, liabilities, and equity are the key components of the accounting equation. |

| What is GAAP in accounting? GAAP is a set of standardized accounting rules that ensures consistency and transparency of financial transactions. |

| What is double-entry accounting? Double-entry accounting is a bookkeeping method to track the financial transactions of the business. debits and credits, balancing, and dual aspects are some of the key features of double-entry accounting. |